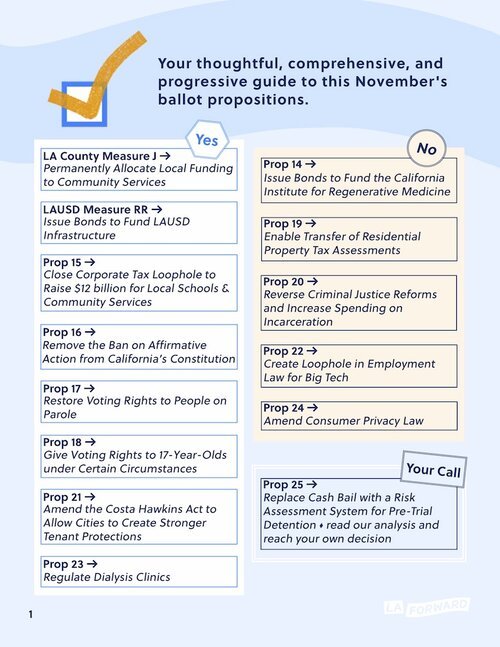

Voter guides

We’ve produced a comprehensive guides to local and state ballot measures for every major election since November 2016. We offer thoughtful analysis and progressive recommendations that you can trust.

November 2022 Guide

LA City Ballot Measures

LA City Measure ULA – Homelessness Prevention - YES

LA Forward Action strongly supports Measure ULA, which also known as United to House LA. The proposition, brought forward by an array of grassroots housing organizations, tenant rights groups, social service providers and labor unions, aims to radically improve and expand the City of Los Angeles’ response to the housing and homelessness crisis by providing funding of about $875 million annually to proven affordable housing and homelessness-prevention programs. Moreover, the proposition is funded through a tax that only the wealthiest Angelenos and corporations, would pay.

The evidence of Los Angeles’ housing crisis is all around us: the 2022 Homeless Count revealed about 42,000 people experiencing homelessness in the City of Los Angeles, but this is only the tip of the iceberg: about half of renters in the City of Los Angeles are severely-rent burdened, meaning they pay over half of their income on their housing—those severely rent-burdened households with the lowest incomes are one emergency or disruption away from ending up on the street or in the City’s over-taxed shelter system.

Vulnerable tenants also suffer from a playing field that is far from level with their landlords. While pandemic-era eviction protections have been critical in slowing evictions in Los Angeles, in the decade prior to the pandemic, Los Angeles County was home to over half a million formal evictions, with evidence that an additional one million informal evictions took place in that period of time. With the City’s eviction protections set to rollback in early 2023, there’s every expectation that this wave of evictions will resume and even accelerate with thousands of LA households behind on their rent due to the economic devastation that COVID-19 wrought on the lowest-income communities.

ULA seeks to address this dynamic through two important types of investments. The measure would direct funding to the long-term investments in affordable housing creation and preservation that will stabilize Los Angeles’ housing market in the long-term, while also putting funding in critical tenant support programs that can keep people in their homes that are at risk of falling into homelessness today.

On the affordable housing side, ULA would allocate 70% of funding towards housing production and preservation. This would include approximately $180 million in annual funding for supportive and affordable housing, $180 million in annual funding for non-traditional models of affordable housing, and another $80 million annually for preservation of existing affordable housing. If passed, this would turbocharge Los Angeles’ production of housing for people with the lowest incomes. In the past, the City has approved one-off investments in affordable housing, which has led to new housing units only becoming available in fits and starts — ULA’s annual funding would get the City of LA’s housing machine humming.

The remaining 30% of funding would go towards tenant rights programs, which provide immediate resources to keep people in their homes. This includes scaling up Los Angeles’ eviction defense programs, issuing cash assistance to people behind on their rent, and providing other supportive services. There would be special assistance to seniors and people with disabilities who have difficulty keeping up with housing costs and who are becoming an increasingly large proportion of the newly homeless. Perhaps most critically, this would bring Los Angeles closer to having a true right to counsel, where any tenant facing eviction would have the right to an attorney. Just having an attorney levels the playing field for tenants: In locales where a right to counsel exists, approximately 86% of represented tenants stay housed.

ULA would raise money through a progressive tax on real estate transactions for properties valued at over $5 million: The proposed tax is progressive, starting at 4% for properties whose value ranges from $5 to $10 million and escalating to a 5.5% tax for properties valued above $10 million. These taxes are not likely to impact your typical Angeleno: the average home value in Los Angeles was just over $970,000 in August 2022, according to Zillow.

ULA is going to generate revenue from transfers of celebrity mansions, large corporate office buildings, and shopping malls, rather than from people feeling the ill effects of the region’s housing crisis. A recent report from some of Los Angeles’ most prominent housing academics found that ULA would have no negative impact on regular Angelenos, with over 75% of funding coming from sellers of properties over $10 million in value. Long story short, the people and corporations who’ve benefitted the most from the skyrocketing value of real estate will pay to address the problem.

In the past, LA’s elected officials have backed put forward initiatives to address homelessness, like Proposition H and HHH. These initiatives have been critical steps forward in advancing LA’s response to address homelessness, leading to a regional system where over 20,000 people are rehoused on an annual basis. Even the much-derided HHH is on a path to provide supportive housing for 13,000 people.

But officials overpromised on the impacts of these measures, which have not fundamentally addressed the issues driving people into homelessness. Measure ULA, drafted by the people and organizations closest to the problem, would bring fundamental change to LA’s housing landscape.

LA Forward Action urges a YES vote.

LA City Measure LH - Authorize More Affordable Housing - YES!

LA Forward encourages LA City residents to vote YES on Measure LH. If approved, Prop LH would allow the construction of an additional 75,000 units of affordable housing Citywide, lifting an artificial cap on housing construction that was created through a racist 1950s-era state law. The measure does not create new funding to build this housing or change zoning — it merely authorizes the City to proceed with creating more affordable housing in the future.

Proposition LH represents one of many hurdles that California jurisdictions must jump through to create new affordable housing. The necessity of passing LH is a result of California’s reactionary history, in which groups like the California Association of Realtors, the Howard Jarvis Taxpayers Association, and other conservative advocacy groups riddled the State Constitution with provisions to make it harder to raise new funding through progressive taxation, to build new housing, and address a range of other equity initiatives.

The particular hurdle that must be surmounted in this case is Article 34 of the California Constitution, which was created through a voter initiative that passed on the 1950 ballot. Article 34 created a system requiring local cities to go to the voters any time deed-restricted affordable or public housing was proposed. This was a victory at the time for the California Association of Realtors (CAR), which backed the measure in 1950 as part of a larger effort to enforce racial and economic segregation through NIMBY housing laws.

In response, cities like Los Angeles, rather than inundating voters with measure after measure of individual affordable housing developments on the ballot, have adhered to the law by periodically going to the voters and asking for authorization for thousands of future potential housing units at a time, broken out at the City Council District-level. With the City swiftly approaching its previously-approved authorization in some Council Districts, including District 1, voters will need to approve Prop LH to ensure that existing efforts to build affordable housing can continue uninterrupted.

Fortunately, California voters will have the opportunity to repeal Article 34 on the 2024 ballot and relegate these artificial caps on affordable housing to the dustbin. This is thanks to a measure authored by State Senator Ben Allen and passed by the California Legislature this year. Even groups like CAR now recognize Article 34 as a product of a racism and support its repeal through the 2024 measure. Until 2024, however, City of Los Angeles voters will need to approve Proposition LH to ensure badly-needed efforts to address the housing crisis can continue.

LA County Ballot Measures

LA County Measure A – Sheriff Accountability - YES

Measure A would amend the L.A. County Charter to enable L.A. County Board of Supervisors would be able to remove a sheriff for severe offenses.

Offenses that would be grounds for removal include violations of law related to a sheriff’s duties, flagrant or repeated neglect of duties, misappropriation of funds, willful falsification of documents, or obstructing an investigation.

Sheriffs would be given an opportunity to be heard before a vote was taken and could be removed only with four-fifths vote of the five County Supervisors who run LA County’s Government.

Measure A was placed on the 2022 ballot through a motion that passed by the Board of Supervisors on a 4-1 vote. Democrats Holly Mitchell, Hilda Solis, Sheila Kuehl, and Janice Hahn in supported it and Republican Kathryn Barger opposed it.

One major reason this initiative is on the ballot this year has to do with the current Sheriff, Alex Villanueva, who’s been mired in controversy since running as a reformer in 2018 and quickly revealing himself to be anything but. Shortly after being elected, Villanueva re-hired a deputy that was terminated over allegations of domestic violence and lying to investigators. Villanueva has also refused to cooperate with county oversight authorities — including defying lawful subpoenas to appear in front of the Civilian Oversight Commission — that are investigating the existence of “deputy gangs.” These gangs are accused of promoting harassment and violence.

Moreover, Villanueva has often attacked critics going so far as to launch a criminal investigation into a Board-appointed Inspector General. On September 14, he targeted the houses for two of his biggest critics — Supervisor Sheila Kuehl and Civilian Oversight Commission member Patti Giggans — for search and seizure. The conduct was so outrageous that the California Attorney General took the case away from the Sheriff’s Department entirely.

In response to Villanueva’s outrageous conduct and a long history of outrageous behavior by the Sheriff’s Department, the Check the Sheriff coalition, an alliance of community organizations and civil rights groups, submitted a letter to the Board of Supervisors with demands for increasing sheriff accountability including the Measure A Charter Amendment.

Opponents of the measure claim that it is an overreach in response to a single sheriff. In reality, the Los Angeles Sheriff’s Department has had a long history of both scandal and daily violations of civil and human rights in both communities and the jail system, which stretches far beyond the current Sheriff. Former Los Angeles Sheriff Lee Bacca was convicted of felony obstruction of justice and lying to the FBI. As an institution, the Sheriff’s department is responsible for the highest litigation costs on settlements, judgments and associated fees for the last 10 fiscal years.

It's an understatement to say that current oversight system for the Los Angeles County Sheriff’s department has proven inadequate. Whether Villanueva wins or his challenger, Robert Luna, does, we need to make sure there is additional oversight and checks on the power of the Sheriff. Even if it’s never used, the possibility of removal should serve instill respect for civilian power into whoever is running the Department.

Measure A is an important step toward correcting the system’s profound problems. We strongly recommend a Yes vote!

State Ballot Measures

Prop 1 - Add Reproductive Freedom to the State Constitution - YES

Proposition 1 would amend the California Constitution to explicitly guarantee individuals the right to reproductive freedom, including the right to abortion and contraception.

Currently, the right to an abortion and to the use of contraception are protected by law in California. Additionally, the California courts have held that the right to privacy, found in the California Constitution, includes the right to make reproductive decisions, such as whether to have an abortion or use contraception.

However, there is no express constitutional right to either an abortion or to contraception. That means future legislatures could pass new laws to restrict abortion rights and the use of contraception, and future courts could overturn precedent to strip away these rights.

As the U.S. Supreme Court’s recent overturning of Roe v. Wade taught us, court interpretation of the California Constitution is not sufficient protection. The California Constitution should be amended to expressly enshrine the right to an abortion and to contraception, thereby ensuring maximum legal protections for reproductive freedom in California.

It’s important to note that if a federal law passed which banned abortion nationally, it would likely override CA’s Constitutional Amendment. That said, it’s still powerful to embed the right to abortion in CA constitution as one obstacle to this type of legislation and to show how much that we, the people, value reproductive freedom.

We strongly recommend you vote YES on Proposition 1.

Prop 26 - Allow more in person sports-betting - NO

LA Forward recommends a NO vote on Prop 26. This proposition, which seeks to address gambling at in-person establishments, may create conflicts with Prop 27, which seeks to address online gambling. If both measures pass, there would likely need to be court action to determine how to implement both measures.

Prop 26 is sponsored by several Tribes, including those that run some of the biggest casinos on tribal land in California. Prop 26 would legalize sports betting at several select locations; currently, sports betting is neither explicitly prohibited nor permitted under California law. Under Prop 26, four private race tracks would be able to host sports betting, as would tribal casinos that reach agreements with the State. Additionally, tribal casinos would be able to expand the types of games they operate at their sites to include craps and roulette.

While the proponents of Prop 26 and Prop 27 are at odds with each other, they put forward similar arguments in favor of legalization: that California, by failing to regulate sports betting, is missing out on key opportunities to capture revenue that can be used to support key public services.

This argument, however, obscures some of what Proposition 26 would accomplish. In addition to legalizing sports betting at select locations, the measure would also make it significantly easier to take legal action against existing card rooms. These card rooms, scattered throughout the state, are legal gaming enterprises that operate exclusively to facilitate card games like blackjack and poker. Unlike the casinos, these card rooms do not have a stake in the game and do not serve as a ‘bank’, contrasting them from the casinos. As a result, the tribal casinos see these card rooms as competitors for business. Prop 26 would give the tribal casinos the upper hand to drive these card rooms out of business.

Better regulating gambling is an attractive idea that the State should consider pursuing — left unchecked, both online and in-person sports gambling are shown to increase gambling addiction, as well as creating opportunities for fraud and abuse of consumers. Prop 26, however, would create a monopoly on in-person gambling, driving smaller players out of the market, while failing to adequately address or regulate the industry. As with Prop 27, LA Forward encourages a NO vote.

Prop 27 - Legalize Online Sports Betting - NO

LA Forward encourages voters to cast a NO vote on Proposition 27. The measure would create an inappropriate regulatory regime for the online sports betting industry while doing too little to address the yawning funding gaps that plague the state’s response to homelessness, contrary to the promises of Prop 27’s backers.

The concept and the arguments in support of Prop 27 are alluring: sports betting is neither formally sanctioned nor prohibited in California. As a result, there are few formal structures in place to give consumers legal recourse when they fall victim to fraud or unsavory business practices. The state is additionally missing out on potential tax revenues that could bolster and stabilize California’s perpetual roller-coaster of a budget and fund key services, including those that address California’s most pressing issue, the State’s homelessness crisis, which has crested with at least 171,000 people experiencing homelessness on any given night in the state.

To address all of these issues, Prop 27 would legalize online sports betting for existing tribes as well as large online betting companies that pay into a state trust fund. The resulting revenues of about $500 million annually would both create an accountability unit to investigate illegal practices while also funding state homelessness and mental health programs.

There are a number of problems with this seemingly straightforward argument, however. First, dozens of American Indian tribes have come out against the proposal, arguing that legalizing online sports gambling would draw business away from the casinos and gambling operations that they operate, thus taking away badly-needed jobs and revenue from historically marginalized communities and moving them into the hands of large, out-of-state corporations.

Second, Prop 27 would allow the large online betting corporations like DraftKings and FanDuel to write the regulations that govern their companies, granting them fairly lax oversight, while also creating a very high barrier to entry in the online gambling market, creating a monopoly in the market that would drive out smaller players.

Finally, the measure would do little to address homelessness and mental health issues, as promised. According to estimates from the Legislative Analyst’s Office, the measure would general a maximum of about $300 million in funding for homelessness. This funding is certainly needed and would be helpful to serve more vulnerable people with housing and services, but is a far cry from what is actually needed to build a meaningful and sustainable response to homelessness. Homeless policy advocates in California have recently called on the state to provide at least $2.4 billion in ongoing annual services and operating funding for local responses to homelessness. While an annual $300 million commitment would be helpful, Prop 27’s backers are overpromising the impact of this funding.

For these reasons, LA Forward encourages a NO vote.

Prop 28 - Dedicated Funding for Arts & Music Education - YES

Proposition 28 proposes setting aside a part of the state’s general fund to go towards arts and music education in all public and charter schools, from preschool to 12th grade. In 1988, Proposition 98 established the minimum funding levels for k-12 schools and Proposition 28 would set aside an amount of the state’s general fund that would equal 1% of Proposition 98 funds. The Legislative Analysts Office estimates that the passage for Proposition 28 would increase education funding by $800 million to $1 billion a year. Funding from Proposition 28 would support a variety of programs including dance, music, theater, painting, sculpture, photography, graphic design, computer coding, animation, music composition, and script writing. Moreover, 80% of Proposition 28 funds will be required to go towards hiring music and arts teachers and aids and the percentage of funds that can go towards administration is capped at 1%. To promote transparency in how Proposition 28 funds are used, school principals will be required to create spending plans and school districts will produce annual reports that include information on funded arts and music programs and teaching positions.

Proposition 28 is supported by a broad coalition. Supporters include many teachers unions (e.g. California Federation of Teachers, California Teachers Association), labor groups (e.g. Service Employees International Union – California, The California Labor Federation), and arts and community organizations (e.g. Arts for LA, Los Angeles Urban League). In addition to these organizational supporters, there are a number of high-profile individual supporters, including former LA Unified Schools Superintendent Austin Beutner and many celebrities in the arts and entertainment industry.

The benefits of arts and music education are well documented. Arts and music education has been linked with improved student outcomes such as improved attendance and test scores. This is part of the reason that California requires K-12 public schools to offer arts education. Yet, despite this requirement, many students don’t have access to high-quality music and arts programs. It is estimated that only 1 in 5 public schools have a full-time arts or music program. The unfortunate reality is that access to these programs is not evenly distributed with low-income students and students of color (vs. higher income students and white students) being less likely to have access. In recognition of this inequity, Proposition 28 would distribute funds according to a formula that would provide a higher allocation of funds in higher need, low-income schools.

That fact that Proposition 28 aims to increase music and arts education funding through a set aside of the state’s general fund – rather than generating revenue through a tax or fee – does represent a potential complication. The state’s general fund is essentially a limited pool of resources and the creation of a set aside for music and arts education may come at the expense of other programs funded through the general fund. This is less of a concern now, with the state having a recent surplus, but may become a greater concern should state resources begin to drop, for example in the case of an economic downturn.

The benefits of increased funding for arts and education programs to California’s students, generally, and low-income students and students of color, in particular, outweigh concerns around the creation of a set aside of the state’s general fund.

We urge you to vote YES on Proposition 28.

Prop 29 - Regulate Dialysis Industry - YES

Proposition 29 would make significant changes to the way dialysis clinics operate.

Dialysis clinics are a rapidly growing sector in the healthcare industry. There are approximately 6,400 dialysis facilities in the United States — these, through Medicare spending alone, generate $31 billion in revenue annually. They exist because people with severe kidney problems have no choice but to use them. If they don’t regularly receive dialysis (a form of filtering toxins out of the blood — what kidneys do naturally), they will suffer severe health consequences, leading to death.

There is not a competitive marketplace for treatment. The two largest dialysis service providers, DaVita and Fresenius, dominate, constituting a supermajority of the 555 privately run clinics in California. Each company generates annual profits of roughly $1 billion, representing a profit margin of more than 18%. These huge profits are coming at the expense of patients. On average, each patient pays $88,000 a year for treatment. (Yes, you read that right.) Safety lapses and improper billing have recurred repeatedly throughout the industry. In 2015, DaVita settled a major lawsuit over steering Medicare patients into using more expensive, private insurance options to pay for their treatments. In 2018, DaVita settled a separate lawsuit for wrongful deaths associated with negligence and withholding critical treatment information. Desperate people make for ample profits. Patients end up having to pay as much as the companies charge and put up with whatever conditions they find at the clinic.

The force behind Prop 29 is a labor union, SEIU UHW, which organizes healthcare workers so they can collectively bargain for better working conditions and higher pay, as well as acting collectively to fight for progressive public policy in general. In 2018, SEIU UHW put Prop 8 on the ballot, which had a mix of similar and different provisions to Prop 29, and then in 2020 put Prop 23 on the ballot, which is quite similar to Prop 29. Both failed after being massively outspent by the dialysis industry and now SEIU is back with a different measure.

The element of Prop 29 that has gained the most attention is the requirement for a medical doctor, nurse practitioner, or physician assistant to be present at the clinic while patients are being treated.

What we see as most important are provisions that would increase fairness, oversight, and transparency.

On that front, Prop 29 would:

• Ban discrimination against patients based on the type of insurance they have.

• Mandate that clinics give notice of any plan to shut down and obtain consent from the state health department before a clinic can close down.

• Require data on patient infections resulting from dialysis be reported by clinics to the state health department, shared with the National Healthcare Safety Network, published on clinic websites. This data must be certified as accurate by an officer of the company that runs the clinic and penalties may be imposed for the clinic’s failure to comply.

It’s especially important that clinics wouldn’t be allowed to discriminate or refuse services based on a patient’s payer, including the patient themself, a private insurer, Medi-Cal, Medicaid, or Medicare. This would mean more people could gain access to services and the companies wouldn’t have a strong incentive to steer people to private insurance over Medicare (which they currently do) and then charge insurance companies more than $150,000 annually per patient, driving up insurance premiums for everyone else. The system is broken and Prop 29 is a good corrective.

Requirements for notice and consent for clinic closure are important to protect patients in rural communities or those who would have to travel long distances if their clinic closed. The dialysis industry is raking in huge profits and they should not be allowed to shut down less profitable clinics when this would inflict major harm on patients who depend on them.

The requirement for having a doctor, nurse practitioner, or physician assistant on staff could improve health and safety and at the very least, it would do no medical harm. The dialysis industry argues that clinics are already safe and effective, and that having a licensed physician on staff at all times will be very costly, and will necessitate the closing of clinics or the limiting of hours and number of patients who can be treated. They claim the requirement will create a shortage of doctors available for other important work. Given the great profitability of the corporate clinics, the threat of clinics closing feels like an overblown scare tactic. Likewise, because nurse practitioners are allowed as substitutes for medical doctors, there is a very small chance that a shortage of doctors would pose a real problem under this law.

We think it’s reasonable for a multi-billion dollar, highly profitable industry that deals with life-and-death care to be especially transparent about the health of its patients with the government and broader public.

SEIU UHW has spent several million dollars in support of this measure. It indirectly advances the union’s interest in building its membership — which we support as a key way for working- class people to gain both respect on the job and power in the political arena — and we see this initiative as an example of labor’s strategy to invest in workers in order to improve patient-care: a win-win.

Opposition largely comes from business interests. The main opponents of the proposition are DaVita Inc. and Fresenius, the two corporations who collectively operate about three- quarters of California’s dialysis clinics and make an estimated $3 billion a year from their California operations. They’ve spent tens of millions of dollars to fight Prop 29 as a threat to their profitability and power. Nearly all of the patient advocacy groups who oppose Prop 29 receive major funding from DaVita, Fresenius, and similar companies, making their position less noteworthy than one might expect.

We are supporting this measure because it will increase transparency and decrease discrimination around patient treatment, provide additional quality control with the presence of a licensed physician, and prevent the companies who run the clinics from closing clinics rather than spend more on care. Although it is not perfect, opponents’ fear-based arguments are exaggerated, and on the whole this measure stands to produce positive outcomes for patients.

We suggest you vote YES on Proposition 29.

Prop 30 - Fund Electric Vehicles & Wildfire Prevention by Increasing Taxing Very High Income Earners - YES

This measure would increase the tax on personal income over $2 million by 1.75 percent to fund programs to support clean vehicles and prevent wildfires. The new tax would apply to the top 0.2 percent of Californians by income, and even for these high earners, the first $2 million in income would be taxed at normal rates, with the increase kicking in only for income above $2 million. The tax increase would result in an additional $3.5 billion to $5 billion in revenue per year that would go to fund zero-emission vehicle purchase incentives and charging stations, while also funding forest management, new firefighters and firefighting equipment.

About 80 percent of the funds raised would go to build charging stations and provide rebates for zero-emission vehicles (with about half of the rebate funding earmarked for low- and middle-income Californians), and the rest would go to provide funding to hire and train new firefighters. The tax increase would remain in effect from 2023 through 2043, or until the state is able to cut emissions to below 80 percent of 1990 levels for three consecutive years, whichever is sooner. In service of its climate goals, California will ban all new sales of gas-powered cars by 2035, and is also requiring that ride-share drivers have 90 percent of their miles traveled in electric vehicles by 2030. As the state prepares for a possible zero-emission future, clean vehicles remain unaffordable for many residents and the state’s charging infrastructure is due for upgrades and expansion. The additional funding and incentives would increase affordability and help to meet the state’s ambitious climate goals and vehicle mandates. Opponents say that this measure would disproportionately benefit Lyft (a significant funder), and that it would unfairly increase taxes on high earners and create a fluctuating funding source, but we believe that the air pollution, climate and fire resilience benefits outweigh the potential downsides.

We support a YES vote on Prop. 30.

Prop 31 - Referendum on Ban on Flavored Tobacco - YES

Prop 31 asks voters to decide if SB 793, California’s ban on tobacco and tobacco product flavor enhancers (with a few exceptions like hookah, premium cigars, and some loose leaf tobacco products) should be repealed.

In 2020, SB 793 by then-Senator Jerry Hill passed with bipartisan support of 77% of the state legislature. The legislature was working to address concerns that tobacco companies were weaponizing fruit and candy-flavored products to further entice a new generation of young tobacco users and get them addicted to their product. With vaping’s popularity amongst young people already on the rise, this would only exacerbate the usage of tobacco. These days there’s no debate that tobacco products have been damaging to public health, and a bipartisan vote of the legislature agreed that allowing these sales would be a backwards step for Californians and our kids. In response, the tobacco industry under the guise of the pseudonym the “California Coalition for Fairness” worked to place Prop 31 on the ballot to legalize the sale of flavored tobacco once again. After all, someone had to stand up to tyranny, obviously, and who better to do that than the honest folks at Big Tobacco?

So here's the thing: Prop 31 isn’t a typical ballot initiative. It’s a special type called a “Referendum,” which gives voters a simple Yes/No vote on a piece of legislation already passed by the legislature and signed by the Governor. Because the referendum rules in California are antiquated, voters are being asked to reaffirm a law already passed rather than strike down a challenge to it. This means that a “Yes” vote is required to ensure a passed law is actually enacted. It’s a little confusing, we know. Given the expensive costs of ballot initiatives in the modern era, only wealthy special interests and the ultra-rich can typically afford to use the referendum process, and they employ this confusing process to their benefit. In the case of Prop 31, said special interest is Big Tobacco.

The good news is that Prop 31’s success sends two messages: 1) that Californians won’t be fooled by Big Tobacco propaganda and 2) that Big Tobacco can’t buy itself out of accountability. California passed SB 793 for a reason, and we have to defend it.

Please join us in making those messages loud and clear by voting YES on Prop 31.